The System That Keeps Your Money Safe

Have you ever got an automated call to your phone asking whether you made a certain transaction? As you may know, this call was generated by a computer. With more than 150 million Visa card transaction per day (1,667 per second), a human is simply not capable of verifying the authenticity of each transaction. Fortunately, advanced machine learning architecture allows all of these transactions to be monitored. But how exactly does the machine monitor all these transactions and how does it determine which transactions are suspicious? In this article, we will explore the basic machine learning architecture behind fraud detection systems and discover how they distinguish genuine transactions from fraud. Every fraud detection system is constructed using fundamental machine learning architecture. The architecture has four main building blocks: input transaction data, a machine learning processor, a historical database and an output mechanism. More modern systems have additional components to ensure the integrity of the system.Input Transaction Data – The moment a debit or credit request is received, the fraud detection system has started working. It sends the location, date, timestamp, transaction amount and the store name to the Machine Learning Processor server.Machine Learning Processor – The inputted transaction data is then compared to the historical database. Using the card velocity machine learning algorithm, the processor is able recognize potentially fraudulent transactions. To calculate card velocity, the location of the first transaction is subtracted from the location of the second transaction to find the distance the card traveled. When transactions are completed online, the location data comes from the IP address. The distance is then divided by the time between the two transactions. If the card velocity is greater than or equal to one (high velocity), then the transaction is flagged as fraudulent because a card cannot travel from Paris to London in 10 seconds. When the card velocity is less than one (low velocity), it is viewed as normal.

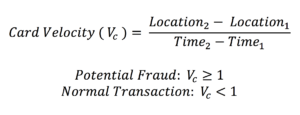

Every fraud detection system is constructed using fundamental machine learning architecture. The architecture has four main building blocks: input transaction data, a machine learning processor, a historical database and an output mechanism. More modern systems have additional components to ensure the integrity of the system.Input Transaction Data – The moment a debit or credit request is received, the fraud detection system has started working. It sends the location, date, timestamp, transaction amount and the store name to the Machine Learning Processor server.Machine Learning Processor – The inputted transaction data is then compared to the historical database. Using the card velocity machine learning algorithm, the processor is able recognize potentially fraudulent transactions. To calculate card velocity, the location of the first transaction is subtracted from the location of the second transaction to find the distance the card traveled. When transactions are completed online, the location data comes from the IP address. The distance is then divided by the time between the two transactions. If the card velocity is greater than or equal to one (high velocity), then the transaction is flagged as fraudulent because a card cannot travel from Paris to London in 10 seconds. When the card velocity is less than one (low velocity), it is viewed as normal.  Card velocity is not the only algorithm that the Machine Learning Processor runs. It also compares habitual spending and flags abnormal amounts.Historical Database – Prior transaction data are stored in the historical database. The database allows the Machine Learning Processor to: 1) compute card velocity, and 2) create a habitual spending profile for the card.Output Mechanism – If fraud is not detected, the output mechanism is an approval on the transaction. If fraud is detected, the output mechanism is typically a denial, followed by an alert sent to the card owner.While there are many more complexities involved, this basic overview of the fraud detection system should help you understand the machine learning architecture that keeps your money safe and secure every second of every day.

Card velocity is not the only algorithm that the Machine Learning Processor runs. It also compares habitual spending and flags abnormal amounts.Historical Database – Prior transaction data are stored in the historical database. The database allows the Machine Learning Processor to: 1) compute card velocity, and 2) create a habitual spending profile for the card.Output Mechanism – If fraud is not detected, the output mechanism is an approval on the transaction. If fraud is detected, the output mechanism is typically a denial, followed by an alert sent to the card owner.While there are many more complexities involved, this basic overview of the fraud detection system should help you understand the machine learning architecture that keeps your money safe and secure every second of every day.

NeuroChain, let’s build a better world!

Photo credits: PexelsFollow us on Telegram, Facebook, Twitter and YouTube. If you have any questions, feel free to get in touch with NeuroChain Team, and we will answer you as soon as possible!